Options strategies in Stock Market

Traders often dive into options trading without fully grasping the breadth of available strategies. However, understanding these strategies can significantly enhance their ability to manage risk and optimize returns. Options offer versatile tools that allow traders to capitalize on various market scenarios, whether bullish, bearish, or neutral. With a strategic approach, traders can harness the power of options to their advantage.

1. Covered Call

A covered call strategy is popular among investors seeking to generate additional income from their stock holdings while potentially selling them at a higher price. This strategy involves owning the underlying stock and simultaneously selling a call option on that same stock. By selling the call option, the investor collects a premium, which provides immediate income. The call option gives the buyer the right to purchase the stock at a specified price (strike price) by a certain date (expiration date). If the stock price remains below the strike price at expiration, the call option expires worthless, and the investor keeps the premium received.

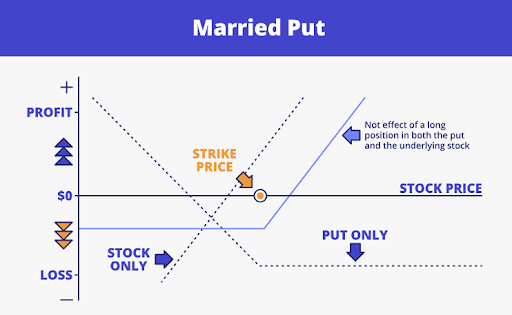

2. Married Put

A married put strategy is used primarily for downside protection while allowing participation in potential upside gains. In this strategy, an investor purchases shares of a stock and simultaneously buys a put option on the same stock. The put option gives the investor the right to sell the stock at a specified price (strike price) by a certain date (expiration date). This strategy acts as insurance against a decline in the stock price. If the stock price falls below the strike price of the put option, the investor can exercise the put option, limiting their losses.

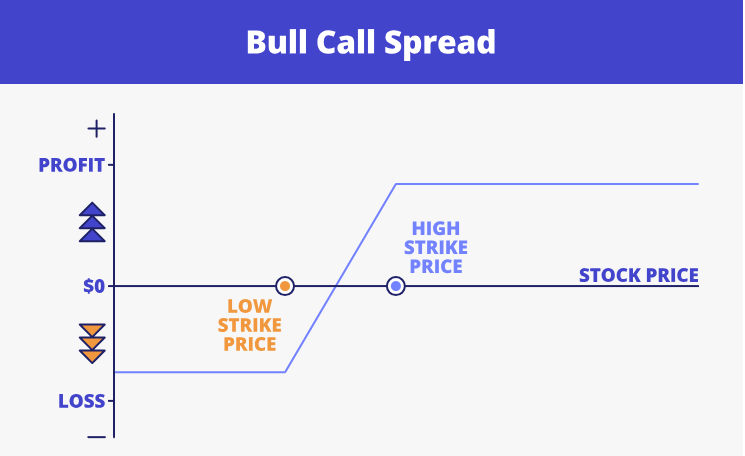

3. Bull Call Spread

A bull call spread strategy is employed when an investor expects moderate upside movement in the price of a stock. This strategy involves buying a call option at a lower strike price and simultaneously selling another call option with a higher strike price, both with the same expiration date. The goal is to profit from a modest increase in the stock price while limiting potential losses.

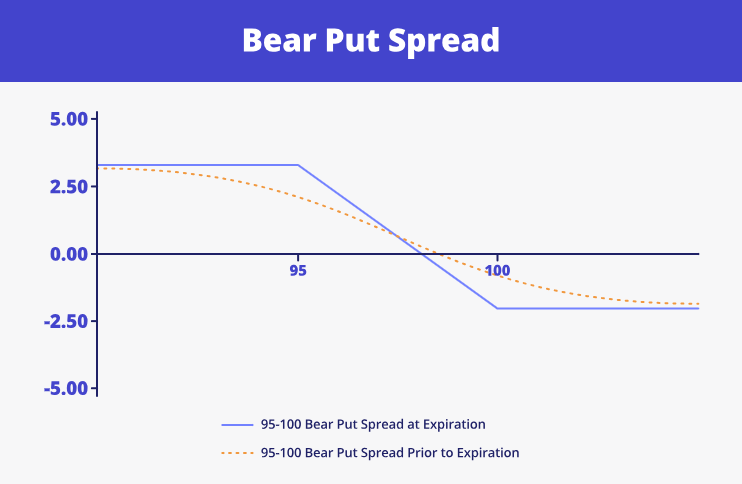

4. Bear Put Spread

A bear put spread is a strategy used by investors who anticipate a moderate decline in the price of a stock. This strategy involves buying a put option at a higher strike price and simultaneously selling another put option with a lower strike price, both having the same expiration date. The objective is to profit from a decrease in the stock’s price while limiting potential losses.

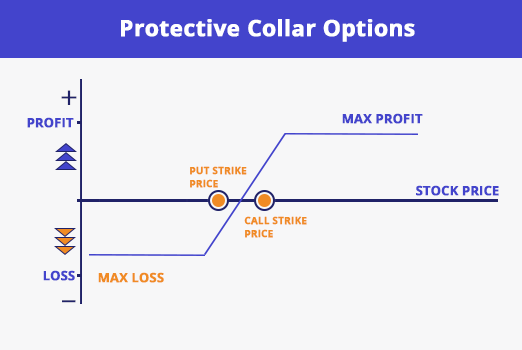

5. Protective Collar

A protective collar is a strategy employed by investors holding a long position in a stock who want to protect against downside risk while limiting potential gains. This strategy involves buying an out-of-the-money put option to protect against a decline in the stock’s price and simultaneously selling an out-of-the-money call option to generate income, typically to offset the cost of buying the put.

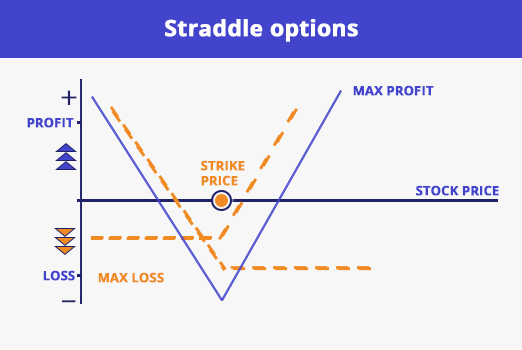

6. Long Straddle

A long straddle strategy involves purchasing a call option and a put option on the same underlying asset with the same strike price and expiration date. This strategy is used when an investor expects significant volatility in the stock price but is uncertain about the direction of the price movement.

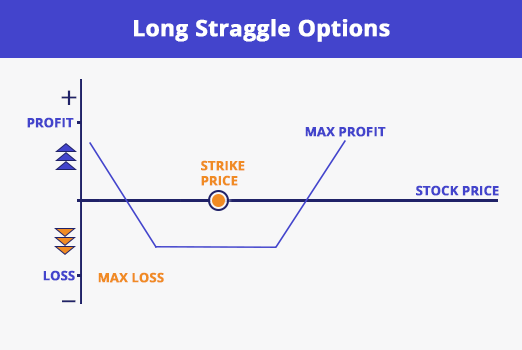

7. Long Strangle

A long strangle strategy is similar to a long straddle, but involves buying an out-of-the-money call option and an out-of-the-money put option on the same underlying asset with the same expiration date. This strategy is used when an investor expects a substantial price movement in the underlying asset but is unsure of the direction of the movement.

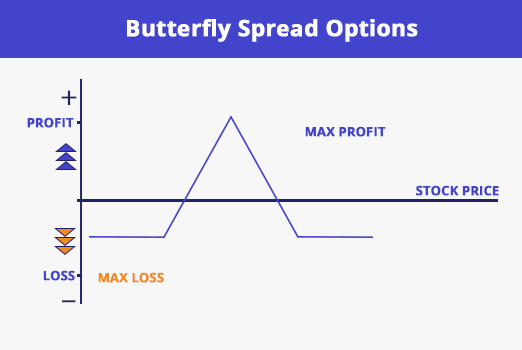

8. Long Call Butterfly Spread

A long call butterfly spread combines aspects of both a bull call spread and a bear call spread. This strategy involves buying one call option at a lower strike price, selling two call options at a middle strike price, and buying one call option at a higher strike price, all with the same expiration date.

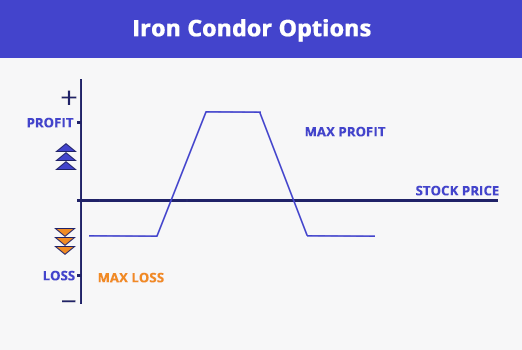

9. Iron Condor

An iron condor strategy involves combining a bull put spread and a bear call spread on the same underlying asset with the same expiration date but different strike prices. This strategy is used when an investor expects the price of the underlying asset to remain within a certain range.

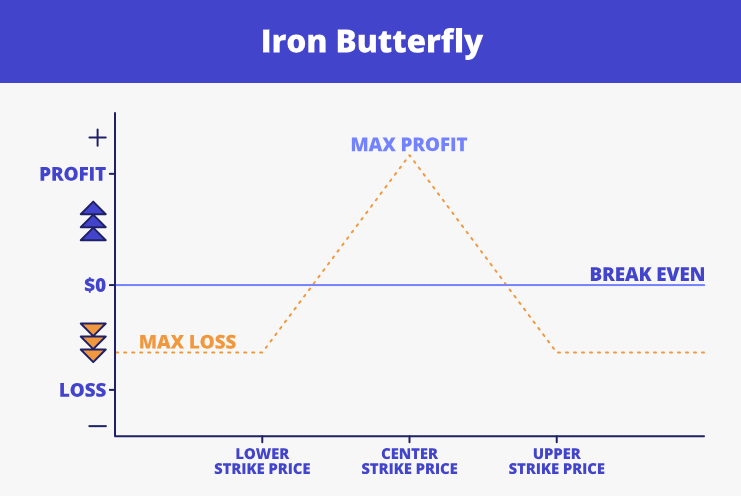

10. Iron Butterfly

An iron butterfly strategy is similar to an iron condor but involves selling an at-the-money put and call option and buying out-of-the-money put and call options on the same underlying asset with the same expiration date. This strategy is used when an investor expects the price of the underlying asset to remain stable at the strike price of the sold options.

These strategies provide a range of approaches for investors to manage risk and potentially profit from various market conditions, whether bullish, bearish, or neutral. Each strategy has its own risk-reward profile and is selected based on the investor’s outlook on the underlying asset and market conditions. Understanding these strategies allows investors to effectively use options as part of their overall investment strategy.