Investing in dividend-paying stocks is one of the most effective ways to build passive income and achieve financial freedom. Dividends provide regular income without the need to sell your investments, making them ideal for long-term wealth creation. Let’s explore how you can unlock passive income with dividends and the key strategies to maximize your returns in 2024.

What Are Dividends?

Dividends are payments made by a corporation to its shareholders, usually in the form of cash or additional shares. Companies typically distribute a portion of their earnings to reward shareholders for their investment. Dividend-paying stocks are often seen as a stable investment, providing regular income and potential for capital appreciation.

Benefits of Dividend Investing

1. Regular Income Stream: Dividends provide a consistent and predictable income stream, which can be particularly valuable for retirees or those seeking supplementary income.

2. Compounding Returns: Reinvesting dividends can lead to compounding returns, significantly boosting your portfolio’s growth over time.

3. Lower Risk: Dividend-paying companies are often well-established and financially stable, offering lower risk compared to growth stocks.

4. Inflation Hedge: Dividends can provide a hedge against inflation, as companies often increase dividend payouts over time, maintaining your purchasing power.

Top Strategies for Dividend Investing

1. Focus on Dividend Yield: Look for stocks with a high dividend yield, which is the annual dividend payment divided by the stock price. This provides a measure of the income you can expect relative to your investment.

2. Dividend Growth: Invest in companies with a history of consistently increasing their dividend payouts. This indicates strong financial health and a commitment to rewarding shareholders.

3. Diversification: Spread your investments across various sectors and industries to reduce risk and increase the stability of your income stream.

4. Reinvest Dividends: Take advantage of dividend reinvestment plans (DRIPs) to automatically reinvest your dividends into additional shares, harnessing the power of compounding.

5. Evaluate Payout Ratios: Assess the payout ratio, which is the percentage of earnings paid out as dividends. A lower payout ratio suggests that the company retains enough earnings to sustain and grow its dividends.

Top Dividend Stocks to Consider in 2024

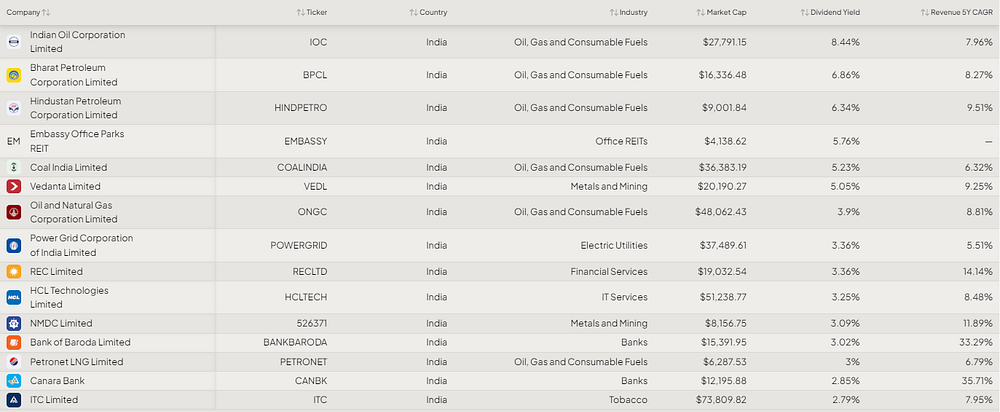

Here are five top Indian stocks known for their robust dividend payouts and strong growth potential:

1. Indian Oil Corporation Limited (IOC)

1. Dividend Yield: Approximately 8.44%

2. Payout Frequency: Annually

3. Why Invest?: IOC has a strong track record of dividend payments, driven by its extensive operations in refining, pipeline transportation, and marketing of petroleum products. The company’s diversified revenue streams and commitment to expanding renewable energy initiatives make it a reliable choice for dividend investors.

4. Revenue 5 Year CAGR: 7.96%

2. Bharat Petroleum Corporation Limited

1. Dividend Yield: Approximately 6.86%

2. Payout Frequency: Annually

3. Why Invest?: Invest in Bharat Petroleum for its consistent dividend payouts, strong market presence, and reliable growth. The company’s diverse operations in refining, marketing, and exploration, combined with its robust financial performance, make it a compelling choice for long-term investors.

4. Revenue 5 Year CAGR: 8.27%

3. Hindustan Petroleum Corporation Limited

1. Dividend Yield: Around 6.34%

2. Payout Frequency: Annually

3. Why Invest?: Invest in Hindustan Petroleum Corporation Limited for its consistent dividend payouts, strong market presence, and diversified operations in refining, marketing, and pipeline transportation. The company’s robust financial performance, extensive retail network, and commitment to sustainable energy initiatives make it a solid choice for long-term investors.

4. Revenue 5 Year CAGR: 9.51%

4. Embassy Office Parks REIT

1. Dividend Yield: Approximately 5.76%

2. Payout Frequency: Twice a year

3. Why Invest in Embassy Office Parks REIT for stable, tax-efficient income through quarterly distributions, high-quality office assets in prime locations, and strong tenant demand from blue-chip companies. The REIT offers consistent rental income, growth potential, and capital appreciation, making it an attractive choice for long-term investors.

4. Revenue 5 Year CAGR –

5. Coal India Limited

1. Dividend Yield: Approximately 5.23%

2. Payout Frequency: Annually

3. Why Invest?: Invest in Coal India Limited for its high dividend yield, strong market dominance as the largest coal producer in India, and stable demand for coal. The company’s robust financial performance, strategic importance in India’s energy sector, and consistent cash flow make it an attractive long-term investment.

4. Revenue 5 Year CAGR: 6.32%

TOP DIVEDEND AND GROWTH COMPANIES IN INDIA 2024

Conclusion

Unlocking passive income through dividend investing is a smart strategy for achieving financial freedom. By focusing on high-yield stocks, diversifying your portfolio, and reinvesting dividends, you can create a sustainable and growing income stream. The top Indian stocks highlighted above offer excellent opportunities for dividend investors in 2024. As always, ensure to conduct thorough research and align your investments with your financial goals. Happy investing!

Disclaimer : The information provided is for educational purposes only and is not financial advice. Investing in stocks involves risks, including loss of principal. Past performance does not guarantee future results. Consult a qualified financial advisor before making any investment decisions. The author is not responsible for any investment actions taken.